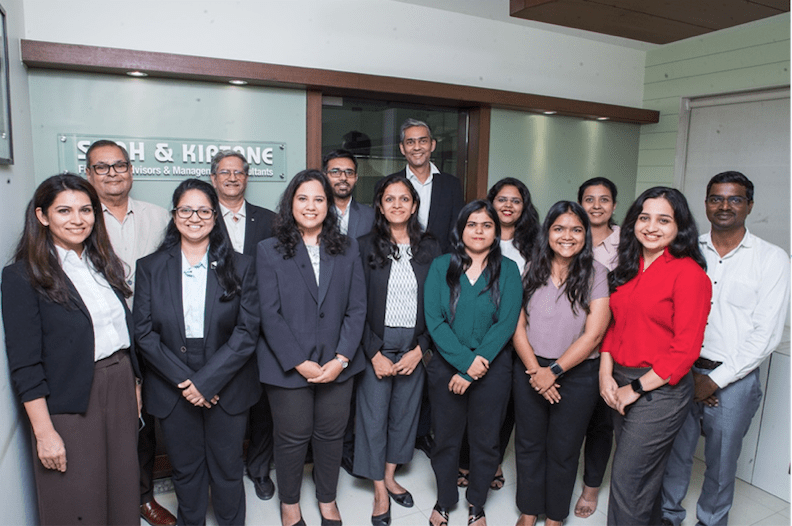

SHAH & Kirtane

Advancing financial confidence for over 25 years

Financial Advisory & Strategic Management Consultants

With more than 25 years of industry experience, Shah & Kirtane has served as a trusted financial advisory and management consulting partner for businesses seeking sustainable growth and long term value creation.

Our approach combines disciplined analysis, integrated financing expertise, and deep sector knowledge to deliver finance services that strengthen organizational resilience and support strategic expansion. We specialize in structuring debt and equity, managing complex transactions, and providing customized solutions across critical sectors.

Sector Expertise & Transaction Highlights

Real Estate

Arranged funding for leading Category 1 developers across Pune, Mumbai, & Bangalore, supporting residential, commercial & mixed use developments.

Industrial Parks & Custom Offices

Secured financing for large private equity backed industrial & logistics park developers for projects across India.

Shipping

Assisted in the acquisition of vessels across multiple countries & jurisdictions, with strong capabilities in managing ship ownership documentation & regulatory requirements.

Road & Infrastructure

Arranged project loans for road infrastructure development across Punjab, Maharashtra, & Kerala, working with agencies such as NHAI & state level infrastructure authorities.

EPC Contracting

Structured working capital facilities & bank guarantees for contractors operating in industrial & commercial construction.

Data Centres

Arranged project financing for pre -leased large scale data centre developments.

Hotels, Clubs & Stadiums

Facilitated funding for greenfield hotel projects in Pune & Goa, as well as financing for clubs & stadiums. Introduced & structured a BOT club financing model.

Manufacturing & Trading

Arranged working capital & term loans for auto ancillary, specialty chemical, foundry, & precision engineering businesses, along with trading focused operations.

Renewable Energy

Secured funding for solar, hydro, & wind power projects, enabling long term clean energy expansion.

Electrical Capital Goods

Advised on the acquisition of a Swedish company with subsidiaries in three countries, structured through a combined equity & debt transaction totalling USD 18 million.

Automotive Industry

Advised on the acquisition & relocation of plant & machinery from a Belgian company to India, supporting asset transfer & integration.

Commercial Real Estate

Advised on the listing of a REIT on the NSE for a client participating in the overall REIT offering.

Automotive, Real Estate & Manufacturing Transactions

Supported a wide range of strategic transactions involving equity & debt structuring, buy backs, hiving off subsidiaries, & other corporate actions aligned with long term value creation.

CLient Testimonials